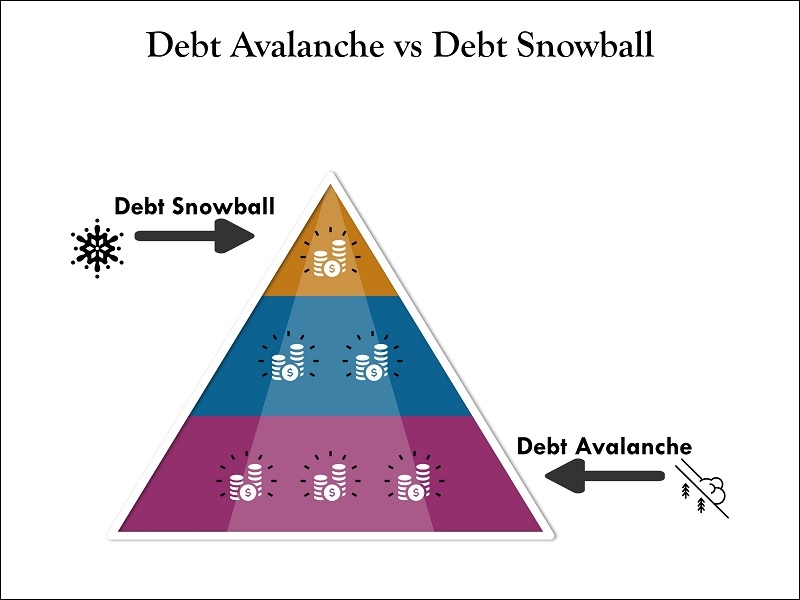

Although getting out of debt is something many people want, becoming debt-free often feels daunting. If you have credit card debt, student loans, or personal loans, you've probably heard of debt snowball vs avalanche. These are two of the most common beginner debt payoff strategies for debt-reduction purposes, especially for people looking to get out of debt to simplify their repayment plan and take control of their finances.

The question is: which one is better for you? Do you pay off the smallest balances first to create momentum, or pay off the highest rates to save money in the long term? Both strategies will get you out of credit card debt faster and accelerate your debt-free journey, but the best option for you depends on your habits, goals, and mindset.

In this guide, we will clarify the debt snowball and avalanche methods, weigh their pros and cons, and help you determine which method will help you pay off your debt more quickly while managing multiple debts at once.

The debt snowball method involves paying off debts from the smallest balance to the highest, regardless of interest rate. The overall theory behind this method is that you will build psychological momentum and continue to motivate yourself by achieving small wins.

With this snowball method, you’d start with credit card A with a $600 balance, even though the interest is highest out of all your debts, and then take on the student loan.

We humans get a thrill through small victories. Completing and paying off a debt, even if the amount is small, excites you to continue. That emotion you feel after taking that initial step makes this one of the best beginner approaches to paying off debt.

The debt avalanche method is more mathematical in nature. Rather than focusing on the size of the balances, you attack the debt with the highest interest rate first. This saves you the most money in interest and, in most circumstances, gets you out of debt quicker.

With the same debts listed above:

With the avalanche method, you’d still start with Credit Card A (because of its high interest rate). But if the balances were different, such as a larger credit card debt with a 25% APR, you’d start there—even if it’s the biggest balance.

Why it works: Mathematically, you'll save more money by paying off your higher-interest debts first. If you are disciplined and are less motivated by small victories, this is the most financially efficient way to do it.

While both strategies lead to debt freedom, their approaches differ significantly:

| Aspect | Debt Snowball | Debt Avalanche |

| Order of payoff | Smallest balance first | Highest interest rate first |

| Focus | Quick wins, motivation | Saving money, efficiency |

| Best For | People who need encouragement | People who want long-term savings |

| psychology | Becomes confident early | Needs discipline and patience |

Both techniques can work for paying off several debts—the decision relies on whether you prefer motivation or money savings.

When determining how to choose between the debt avalanche vs snowball, ask yourself:

If you need quick wins to stay motivated, the snowball method may be your best option. Limiting high-interest balances and paying off lower balances immediately creates a sense of accomplishment.

The avalanche technique will save you more money if you can retain discipline without psychological reinforcement.

Other times, a combination strategy is the way to go: pay off a few low balances here and there for encouragement, then switch to focusing on high-interest debt.

Pros:

Cons:

Pros:

Drawbacks:

Credit card balances are usually the biggest obstacle for borrowers because they have the highest interest rates. Whether the debt is snowball or avalanche, it is important to have a strategy to eliminate it.

Either way, these are the ways to pay off debt faster:

For someone with multiple credit cards, multiple student loans, multiple car payments, and multiple personal loans, paying off multiple debts may feel overwhelming. Using either the snowball or avalanche simplifies repayment by offering some level of order in the repayment process.

There are also several things you can do:

Starting your debt-free journey doesn't have to be hard. Besides the snowball and avalanche methods, here are some easy steps for beginners:

Consistency is more important than the approach you take. The approach you select is less important than your determination to follow through.

Going debt-free isn't a math exercise—it's a state of mind. Here are some debt-free journey motivation tips to keep you strong:

Keep your goals in perspective—such as financial independence or owning a home.

This provides you with the psychological victories of snowball but with the long-term savings of an avalanche.

When it comes to debt snowball vs. avalanche, there isn't a single solution that fits all. Both are effective methods for paying off several debts, eliminating credit card debt, and eliminating debt more quickly.

Regardless of the method you choose, the important thing is that you have committed yourself to becoming debt-free. With discipline, smart decisions, and consistency, you can have freedom from the worry of money.

This content was created by AI