The excitement of getting a job for the first time or starting a new position is initially dulled when you see your paycheck and find out that the net amount credited to your bank account is less than the salary you were told. The discrepancy in the salary you see on your bank account and the salary you were told about is because of deductions.

This blog will help you understand paycheck deductions in simple terms, showing you the taxes that are taken from the payroll, how to calculate your take-home pay, and how to confidently read your paycheck.

In most cases, the money you receive in the form of salary is not equivalent to your gross pay. Gross pay is the total amount of money that a person is entitled to receive before any deductions are made. What you collect from your bank account is your net pay, also called take-home pay.

The knowledge of the deductions from your paycheck will help you become the master of your finances. You will be able to confirm your actual income by budgeting your expenses accordingly. Knowing what mistakes to look out for by doing comparisons will protect your earnings.

Although the term payroll may come off as a daunting one, it is just the system that employers use to keep track of employee salaries and the payments made for them. The payroll basics explained in a simple way are:

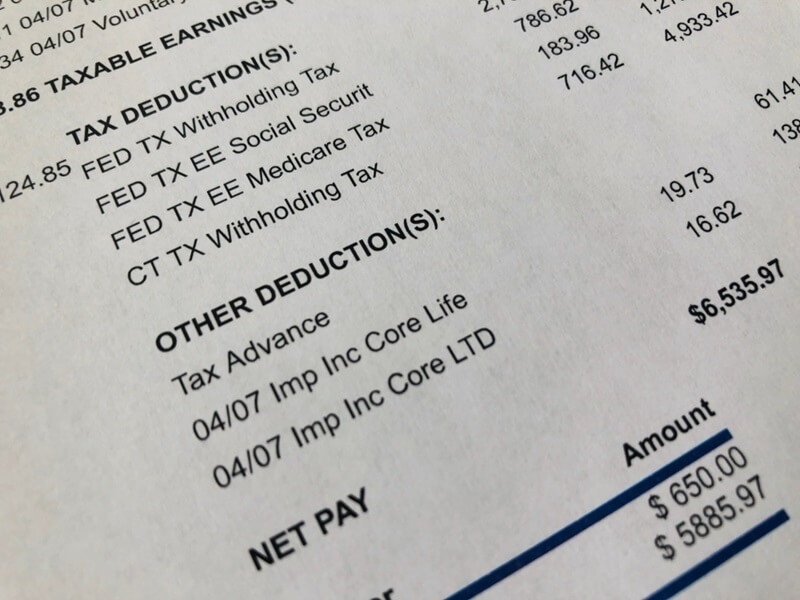

Your paystub is just like a receipt that it lists information about these details. It indicates what taxes are taken from earnings and also what other deductions are made such as retirement contributions or insurance premiums.

Most of the deductions are for taxes. To understand the question of what taxes are taken from paycheck earnings is to understand that this is where most of your money will be going:

This is taken from your pay based on the details that you give in your tax form (like the W-4 in the U.S.). The value is influenced by your income level and filing status.

Not all states have income taxes, but if yours does, it will be indicated as a separate line on your paycheck.

A certain part of your wages is used to support Social Security, a program that takes care of elderly and disabled people.

This is the health insurance that covers people who are over 65 or have specific disabilities.

As a result, when you add these together, you realize that your net pay is lower than your gross pay. A big step in reducing the intimidation factor in the whole process is to learn these payroll basics explained in plain language.

As a novice worker, the numerous lines on your payslip might confuse you. A paycheck breakdown for beginners that shows what a typical payslip consists of:

Displays your standard pay, extra hours, and the perks you got. It gives you an insight into how your gross wages were calculated.

It shows the federal, state, local, Social Security, and Medicare amounts. The most considerable deductions are made on that account.

Whether it is through health insurance, dental coverage, or retirement savings, the fund will show the amounts that have been withdrawn for your allocated plans.

Some employers can match the amount you put into the retirement plan or pay part of a health insurance premium for you. So, although the money does not come out of your paycheck, it is still good to know the amount of support your employer is giving you.

The most important line for you is the money that goes into your account.

By looking at this paycheck breakdown for beginners, you will recognize the typical information that will appear in a payslip. For instance, if you work for more hours, then naturally your wages will be higher but the taxes will increase just a little bit.

The skill of figuring out your actual take-home pay is very handy in money management. You need not be a genius in mathematics; just follow the steps below:

Your salary is split into the number of pay periods chosen to get your gross pay. For instance, if your annual income is $48,000 and you are paid monthly, then your gross pay will be $4,000.

Try to come up with numbers for the following deductions; federal, state, Social Security, and Medicare. The use of online calculators can make this task easier.

If you have opened a retirement account or receive insurance with the help of your employer, those amounts should be deducted in the next step.

The money that is left behind is your take-home pay. Learning the process of take-home pay calculation is empowering as it lets you anticipate your monthly income and manage your budget without playing the guessing game.

If you want to have a clear idea of the amount that is deducted from your paycheck without feeling that you need to decode words, it is helpful to get it broken down into simple terms. Paycheck terms are:

Once you understand these terms, your paystub will no longer feel like a foreign language.

There are many deductions for which less money is taken from income, and taxes constitute the biggest part of all deductions, but those are the ones most commonly known.

These deductions are directly beneficial to you, so it is worth knowing them. Most of them are pre-tax, which means that they have the potential to lower your taxable income and thus your tax bill.

Even two employees who have the same salary and work at the same place are likely to get different net salaries or take-home pay. This is due to the fact that deductions are a very personal matter.

For instance, one of the employees may decide to defer more of his retirement savings while his colleague may take on the medical coverage for their family. Tax withholdings also differ based on marital status or the number of dependents claimed.

Once you have understood the paycheck deductions and you want to keep up with your pay stub, then this is the time for the tips.

The simple errors can cause the loss of your money, so being careful will help you to protect your wages.

Getting paid is a pleasure, but it can also be confusing if you do not have the right information. Understanding your deductions is a great step towards financial clarity, and it will give you confidence. Along with payroll basics made simple, learning what taxes are taken from paycheck earnings, and learning how to read your pay stub will be easy.

Next time, when you look over your paystub, it will definitely not feel like a riddle; you will feel confident with your financial skills.

This content was created by AI