The investment in 2025 must be based on a clear understanding of stability, sound planning, and risk recognition. Control, shifting markets, and new opportunities, which come with the economic uncertainty, demand strategies that can withstand various conditions on the part of the investors. A strong portfolio does not involve speculation: it is the establishment of long-term stability.

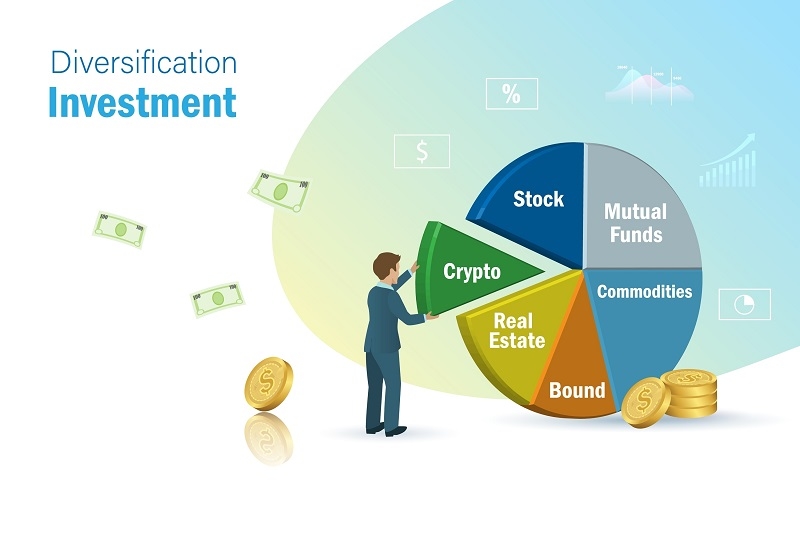

One of the strongest methods for reducing risk and achieving consistent returns is a diversified portfolio. The concept is very straightforward: diversification of your money into various kinds of assets in order to have it even out in case one of your investments fails.

Stocks can be used to offer growth, whereas bonds offer stability. A moderate combination will provide investors with security and the opportunity to get returns. E.g., when the stock market falls, bonds can cushion you against huge losses.

Real property or commodities provide an additional degree of security. They tend to act in a different manner than stocks and bonds, and this becomes handy in the process of diversifying risk.

The USA is not the only country to be pursued by investors. International investments would have a stronger investment portfolio due to the fact that the global economies are not always heading in the same direction.

The world today is overwhelming to invest in. That is why, by adhering to a simple investment guide in 2025, it is possible to remain focused and clear in the decisions.

The questions to be posed before investing include: What are you investing in? Retirement, a house, or wealth to build your family? Goals aid in deciding the extent of risk to be taken as well as investments that suit you.

Investment choices depend on your investment horizon or the period you intend to hold your investment. The long-term investor can afford to risk more, whereas the short-term objective may demand the use of less risky and more stable securities.

Not everyone feels the same about market ups and downs. Some people can handle short-term losses, while others may find it stressful. Knowing your comfort level with risk helps you avoid panic decisions later.

Every investment carries risk, but smart risk management helps you protect your money. Instead of fearing risk, learn how to handle it wisely.

One of the biggest mistakes investors make is putting too much money in one stock, one sector, or one type of investment. Spreading your money lowers the chance of a major loss.

Markets change quickly. What worked last year may not work today. Checking your portfolio regularly and making adjustments helps you stay on track.

Even the best investments cannot replace the need for cash savings. An emergency fund gives you security in case of sudden expenses, so you do not have to sell investments at the wrong time.

Resilient investment strategies are about creating long-term growth while keeping risks under control. They allow you to stay steady even when markets shift.

Technology plays a bigger role in investing than ever before. In 2025, digital tools can help investors make smarter choices and monitor their portfolios.

Robo-advisors use algorithms to create and manage portfolios. They are affordable, easy to use, and suitable for beginners who want guidance without high fees.

Many apps now offer real-time tracking, financial planning tools, and personalized suggestions. These tools help you stay informed and make better decisions.

Artificial intelligence is being used to predict market patterns and risks. While not perfect, these tools provide useful insights that can support smart risk management.

Retirement planning is one of the most important reasons to build a resilient portfolio. In 2025, with longer life expectancy and rising costs, preparing wisely matters more than ever.

Accounts such as 401(k)s and IRAs offer tax benefits that can grow your money faster. The earlier you begin, the more your investments can compound.

Younger investors may invest more in stocks for growth, while older investors often shift toward safer bonds and income-focused assets. Adjusting risk with age is a key retirement strategy.

One of the largest costs in retirement can be healthcare. This is something to include in your financial plan, and you will be prepared to face the future.

The 2025 economy is associated with its opportunities and challenges. To the investors who adapt to changes, they can save their portfolios and seek new growth.

Inflation decreases the worth of money in the long run. This risk can be covered by assets such as real estate, commodities, or inflation-protected assets.

Interest rates influence both returns on borrowing as well as investment. An increase in the rate will slow down the stock market, but will favour savings accounts or bonds.

There are industries like clean energy, technology, as well as healthcare that will continue to expand in 2025. Listening to such trends assists investors in making wise decisions.

A strong portfolio is not just about anything; it is also a matter of individual discipline and prudent practices.

The process of creating a resilient portfolio in 2025 is all about a balanced approach, discipline, and intelligent planning. Having a diversified portfolio in 2025 will allow you to cushion against sudden losses, whereas having an investment guide in 2025 allows your decisions to remain target-oriented and focused. Airbnb provides long-term investment growth, which is essential in difficult times, and Smart risk management is a method of preserving your money. A combination of technology, retirement planning, and maintenance of economic trends can help you create a portfolio that is well-balanced in any market. Most importantly, the successes of investing are in patience and permanence.

This content was created by AI